China’s Smartphone Industry to Enter a 'Strong Structure, Weak Volume' Phase in 2026

This year's Double 11 smartphone market was characterized by "demand pulled forward, structural premiumization, and a reshuffled competitive landscape.

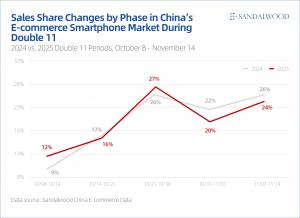

HONG KONG, HONG KONG, CHINA, December 12, 2025 /EINPresswire.com/ -- Looking Ahead from Double 11: Industry Growth in 2026 Relies on Structure, Not VolumeAccording to Sandalwood's China e-commerce market data, this year's Double 11 smartphone market was characterized by "demand pulled forward, structural premiumization, and a reshuffled competitive landscape." While it saw modest growth in units sold (+6%), sales value (+13%), and ASP (+7%), this growth was not evenly distributed. Instead, it was heavily concentrated in the early phase, indicating growth was driven not by a demand recovery, but by a significant forward-pulling of demand.

Specifically:

• The pre-sale period in early October became the main peak, with units sold, sales value, and ASP growing +38%, +62%, and +17% respectively, showing a concentrated surge. This resulted from intensified brand promotions, enhanced channel pre-sale mechanisms, and users locking in orders early.

• However, growth during the Double 11 week itself narrowed sharply to 0%, -4%, and -3%, failing to show the typical "second peak." This indicates that potential demand was exhausted during pre-sales, leaving the main sales period unable to significantly boost the overall market.

This "strong start, weak finish" pattern clearly shows replacement demand remains cautious, the marginal effect of promotions is diminishing, and users are increasingly sensitive to both price and value.

Growth Shows a Clear Structural Concentration Effect

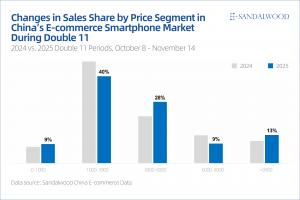

Against the backdrop of generally stable overall demand, this year's Double 11 growth primarily manifested as an accelerated shift towards higher price tiers.

Data from Sandalwood shows growth was highly concentrated in the ¥3,000-6,000 and ¥9,000+ price bands. The former saw steady growth, driven by flagship features trickling down, improved overall product capability, and gradually accumulating replacement demand. The latter maintained strong performance, supported by extended replacement cycles for premium users and compelling new flagship models.

In contrast, mid-range demand (¥1,000-3,000) remained weak, yet to recover due to cautious consumer spending. The premium mid-range (¥6,000-9,000) weakened under pressure from both higher-end models and more cost-effective alternatives. This shows Double 11 growth was not broad-based but concentrated, pulled towards more valuable mid-to-high price segments by a combination of supply-side premiumization strategies, policy-side subsidies, and user segmentation.

Future premiumization is likely to continue, though its pace will depend on costs, subsidy policies, and the pace of demand recovery.

Structural Premiumization Driven by Pro Models: Standard Version Growth Slows

This structural shift is even clearer at the product level.

According to Sandalwood data, sales of Pro/high-end series grew ~+20% YoY, significantly outpacing the ~+5% growth for standard versions. New growth concentrated in mid-to-high end segments offering clearer differentiated value.

For manufacturers, the core driver of this structural upgrade comes from these high-potential series. Their standout features—in imaging, performance, design, or AI—are more effective at capturing user attention and driving real incremental growth.

Simultaneously, another important change occurred: the concentration of top series decreased. The share of the top 10 series dropped from 61% to 55%, signaling that the era of dominance by a few top series is loosening. Instead, mid-range flagships and niche products with clear selling points are gaining prominence.

This indicates user purchasing decisions are shifting from "comparing prices" towards "seeking clear value." In an increasingly saturated market with lengthening replacement cycles, only products with standout, recognizable core features can achieve hit status.

Conclusion: This year's Double 11 did not signal a broad-based demand recovery. Instead, it was defined by forward-pulled demand, growth concentrated in specific price bands, and competition driven by superior product capability. For manufacturers, the strategy of covering all price bands to gain scale is becoming less effective. Resource allocation is shifting from "spreading efforts widely" to "doubling down on key SKUs."

Future market growth will rely more on core products with high value density, capturing limited but higher-quality increments with greater product strength. In other words, the focus in a saturated market is no longer "how much do we cover," but "which few products can we make truly strong." This trend is highly likely to influence product planning and market strategy for 2026 and beyond, pushing the industry further towards superior products, a hit-driven logic, and structural growth.

Carson Collins

Sandalwood Advisors Limited

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.