Fortuna advances $19 million generative exploration program across Côte d’Ivoire, Mexico, and Argentina

VANCOUVER, British Columbia, Sept. 10, 2025 (GLOBE NEWSWIRE) -- Fortuna Mining Corp. (NYSE: FSM | TSX: FVI) is pleased to provide an update on its $19 million generative exploration program across its portfolio of projects in Côte d’Ivoire, Mexico, and Argentina.

Paul Weedon, Senior Vice President of Exploration at Fortuna, commented, “This year, Fortuna has stepped up generative exploration activities across its portfolio, with a strong focus on identifying and advancing the next generation of projects.” Mr. Weedon concluded, “By leveraging our in-country expertise and dedicated exploration teams, we are unlocking new opportunities for future growth. With a 2025 Greenfields exploration budget of $19 million, complementing the $22 million Brownfields exploration budget, the generative teams have been active in advancing several promising projects.”

Generative Exploration highlights

Guiglo Project, Côte d’Ivoire

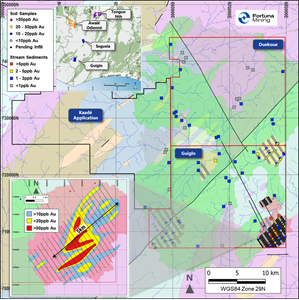

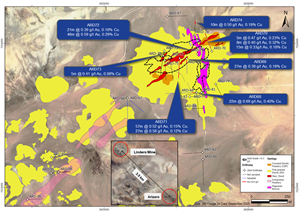

The Guiglo Project consists of two permits granted in late 2024 and a third under application, covering a total of 1,142 square kilometers in the southwest of Côte d’Ivoire. Guiglo encompasses an unexplored area of favorable Birimian stratigraphy, hosting several large-scale geophysical structures.

Stream sediment sampling during the 2024 to 2025 field season identified four anomalous catchments. Follow-up soil sampling on the highest priority catchment, conducted on a 250-meter by 50-meter grid, outlined a 5-kilometer by 2-kilometer anomaly exceeding 20 parts per billion gold, with coincident bismuth, tungsten, antimony, and molybdenum anomalism (refer to Figure 1).

Field work is scheduled to resume after the rainy season in October 2025, with additional sampling, auger drilling, and an induced polarization geophysical program planned.

Figure 1. Guiglo Project exploration program, Côte d’Ivoire

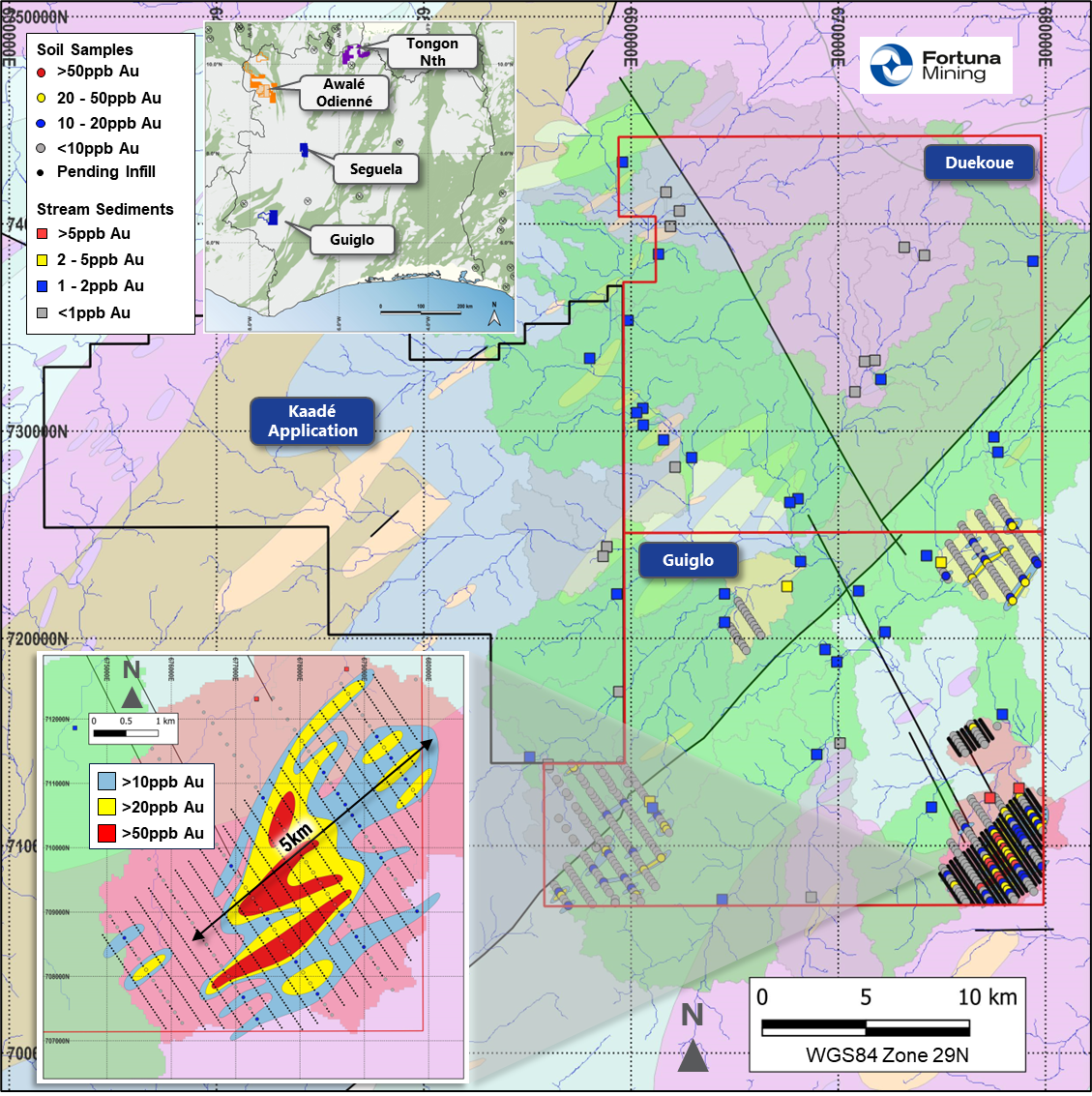

Tongon North, Côte d’Ivoire

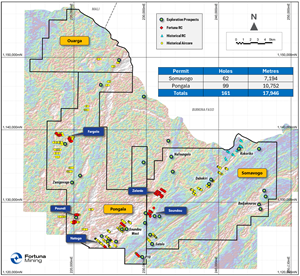

The 2024 to 2025 field season saw an active exploration program across the core of the Tongon North Project. Activities included first-pass scout reverse circulation drill testing of previously untested priority coincident geochemical and geophysical targets, as well as mapping and grab sampling of numerous newly identified artisanal zones.

Preliminary targets, including Poundi, Natogo, and Fargolo on the Pongala permit, and Zelenio and Soundou on the contiguous Somavogo permit, are interpreted to be associated with key fertile structures extending northeast along strike of Barrick’s Tongon Mine (refer to Figure 2).

Following the receipt of all remaining assays, a rate-and-rank exercise will be undertaken to prioritize targets for follow-up exploration. Fieldwork is anticipated to recommence in November, weather and access conditions permitting.

Figure 2. Tongon North exploration program, Côte d’Ivoire

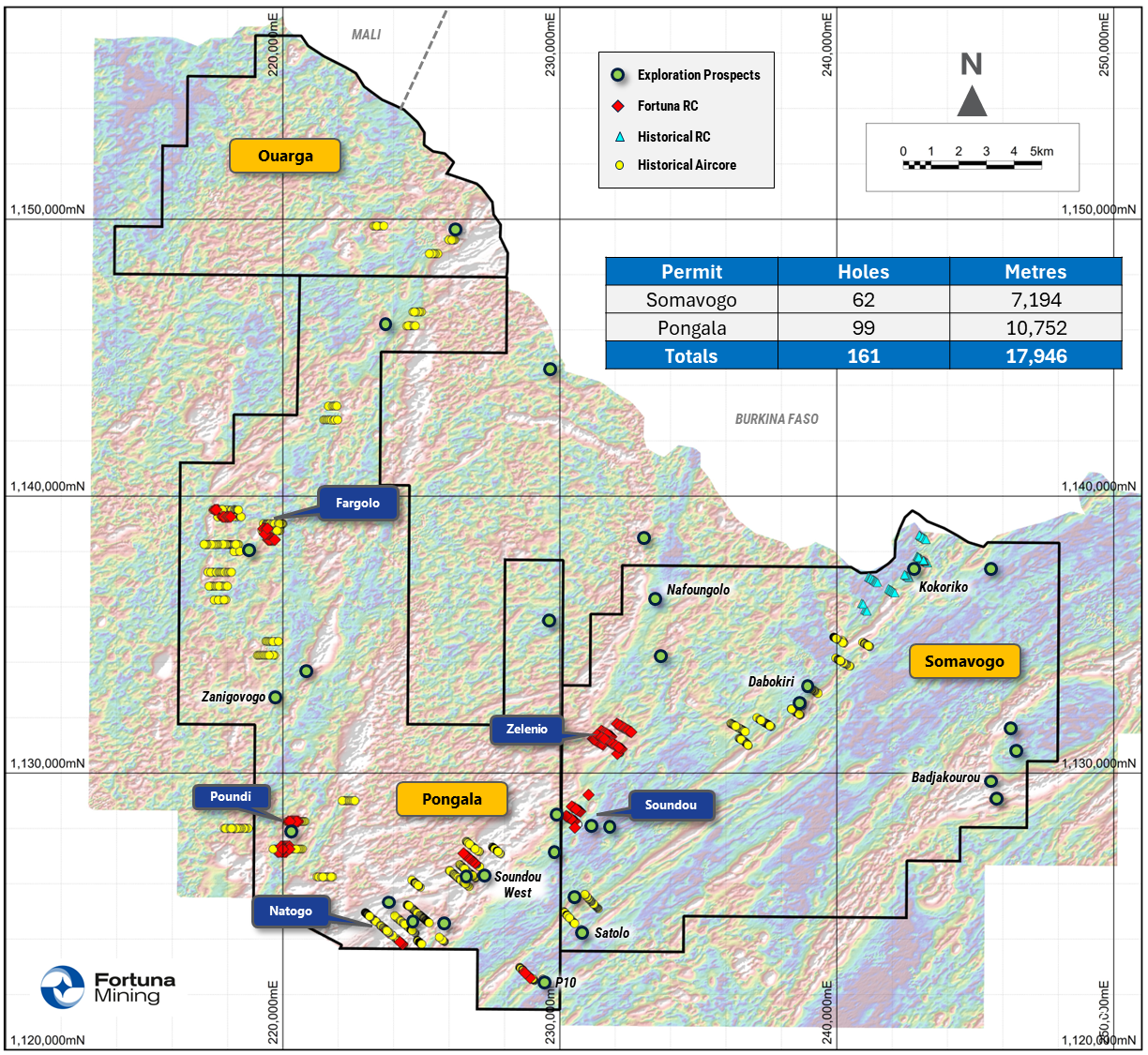

Centauro Project, Mexico

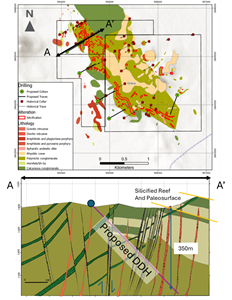

The Centauro Project is a highly prospective gold and silver opportunity located in southeastern Chihuahua, approximately 145 kilometers northwest of Torreón, Coahuila (refer to Figure 3). In February 2025, Fortuna obtained option rights on Centauro, allowing it the ability to earn 100 percent interest in three claims totaling 600 hectares. Fieldwork on the Centauro project has commenced.

Historical exploration work conducted by previous companies includes 19 mostly shallow drill holes completed during 2008 to 2009, which returned widespread anomalous gold and silver values with associated pathfinder elements such as arsenic, antimony, mercury which are indicative of a fertile epithermal system.

Recent mapping and geochemical sampling confirm the presence of a large 2-kilometer by 3-kilometer silica-capped plateau displaying features consistent with a preserved hydrothermal paleosurface, including sinter horizons, finely banded silica, mud cracks, and geyserite. Surface mapping has outlined several north-west trending silicified structures (refer to Figure 4), while the presence of low-temperature sulfides such as realgar, orpiment, cinnabar, and stibnite further supports the interpretation of a high-level preserved precious metal system.

Fortuna will commence a first pass drill campaign next month to test the potential for a fully preserved low to intermediate sulfidation gold and silver system at depth.

Figure 3. Location of current exploration programs in Mexico

Figure 4. Centauro Project, Mexico: Geological plan and interpretive cross section

La Carmen Project, Mexico

Early-stage exploration is advancing at the La Carmen Project, located approximately 145 kilometers northwest of Mexico City in the state of Querétaro. The project hosts a high-level epithermal system expressed by widespread kaolinite alteration extending over an area of more than 5 kilometers by 5 kilometers, locally exposed beneath post-mineral basalt cover. The geologic setting is considered analogous to the Naranjillo and Sinda deposits, owned by Fresnillo and Electrum, respectively.

Mapping has outlined three main zones across a 5-kilometer by 6-kilometer area, characterized by well-developed displacement faults, sub horizontal zones of silicification, and the presence of cinnabar, all indicative of the potential for a fully preserved epithermal system at depth.

Surface access agreements over the principal target areas are underway. Once secured, the Company will commence detailed geological mapping and systematic geochemical sampling, supported by hyperspectral analysis, to refine alteration mineralogy and vectoring ahead of a maiden drill campaign.

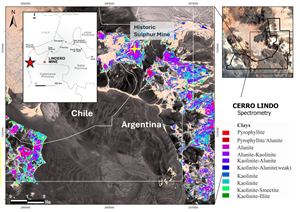

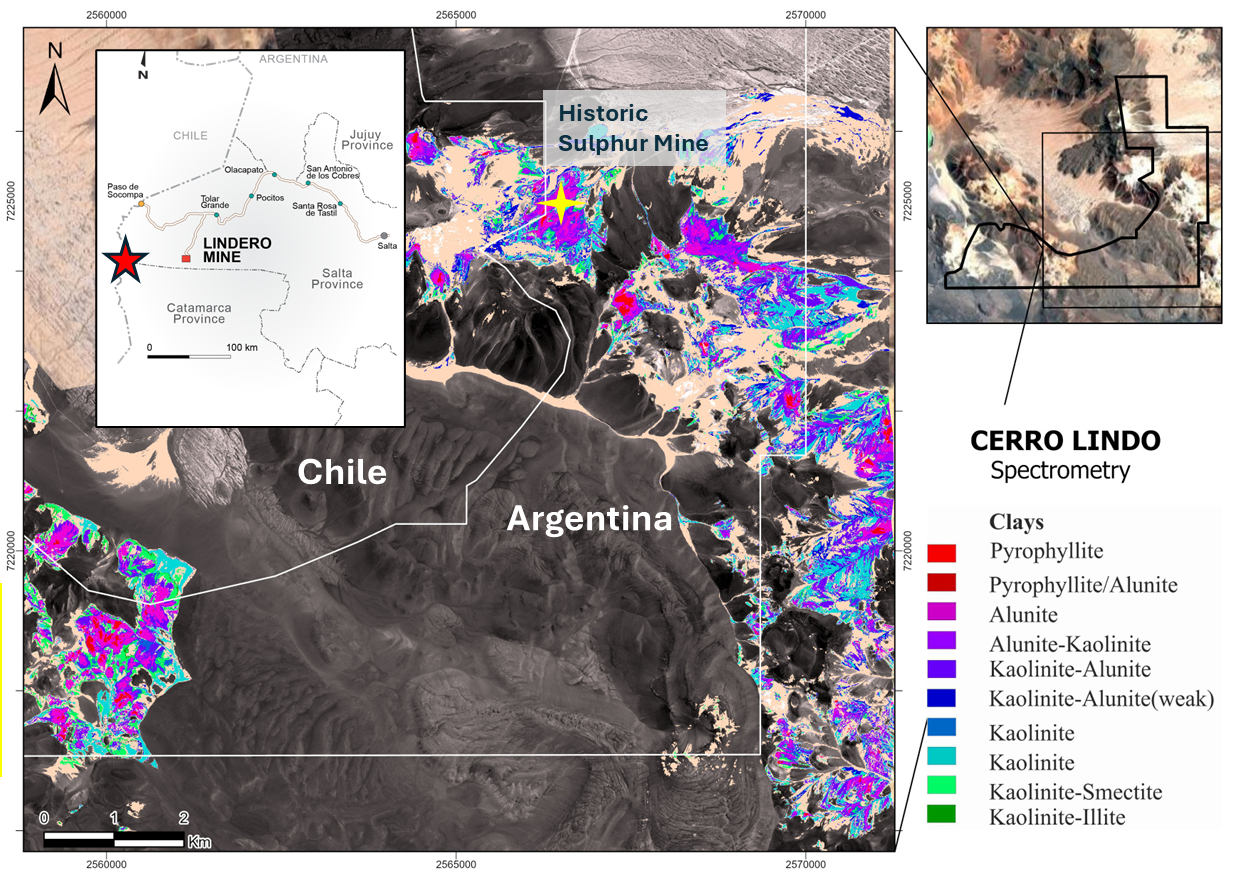

Cerro Lindo Project, Argentina

Located approximately 70 kilometers west of Fortuna’s Lindero Mine (refer to Figure 5), Cerro Lindo is characterized by an extensive 12-kilometer corridor of steam-heated alteration in Tertiary-aged andesitic volcanics, partially overlain by younger unaltered Miocene aged andesitic and basaltic flows, and includes a historic sulfur mine that was operational between 1940 and 1978. An option agreement to explore the 95 square kilometers Cerro Lindo Project was entered into during the quarter.

The property is considered prospective for hosting a high-sulphidation epithermal gold and silver system, analogous to Gold Field’s Salares Norte Project, located 125 kilometers to the south in neighboring Chile. Previous geochemical sampling has identified extensive areas of broad gold and silver anomalism with significant pathfinder elements including molybdenum, antimony, bismuth, tellurium, tin, lead, barium, tungsten, and selenium, as well as extensive quartz-alunite alteration and polymictic breccias.

Figure 5. Cerro Lindo, Argentina: Location and spectral imagery

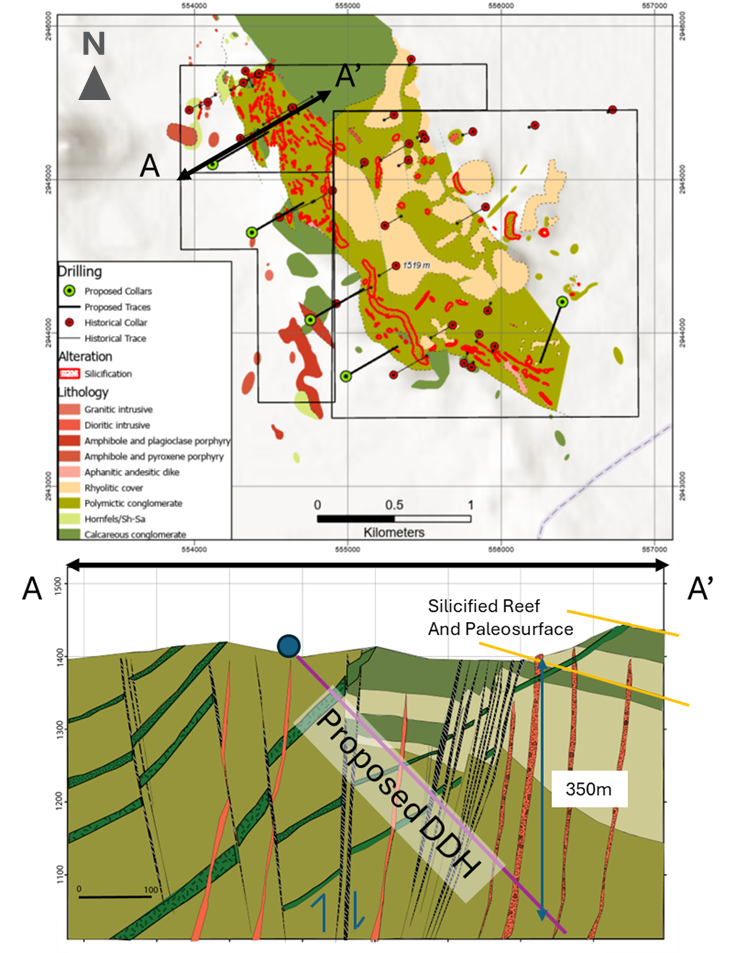

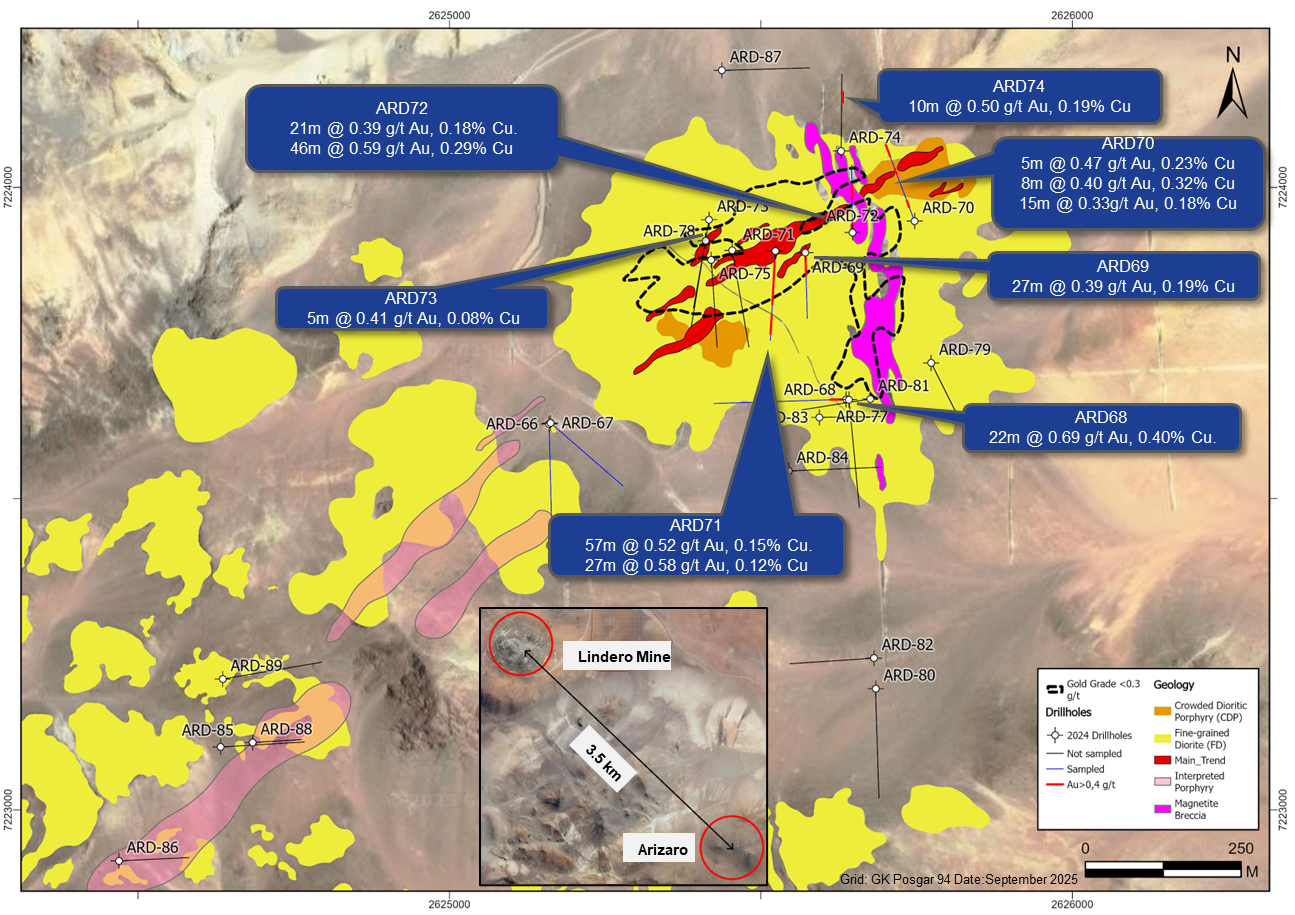

Arizaro Deposit, Lindero Property, Argentina

Located 3.5 kilometers southeast of the Lindero Mine, the Arizaro deposit is dominated by moderately to strongly mineralized south-west trending non-outcropping diorite intrusive, which hosts most of the existing Inferred Mineral Resource of 32.4 Mt averaging 0.37 g/t Au containing 389,000 ounces of gold (refer to Fortuna news release dated March 12, 2025, “Fortuna reports updated Mineral Reserves and Mineral Resources.”) A second style of mineralization has been identified at Arizaro, consisting of north-south oriented magnetite-rich and potassic altered igneous-cemented breccias.

A total of 14 diamond drill holes were completed for 3,674 meters, with the program designed to investigate strike extensions and infill elements of the current resource. Drill results have been received for 7 drill holes to date.

Regional mapping and associated rock chip sampling have also highlighted a 2.5-kilometer southwest-trending anomalous gold and copper zone extending from the Arizaro gold-copper porphyry system (refer to Figure 6). Multiple occurrences of fine quartz-magnetite veining hosted by a diorite intrusive similar to that intersected at Arizaro have been identified. This work has led to a re-evaluation of the potential extent of the host porphyry and emplacement history. Several targets were tested with 2,826 meters of diamond drilling in 10 holes, with results received for 2 to date.

Arizaro Deposit drilling highlights:

| ARD68: | 0.69 g/t Au, 0.40% Cu over an estimated true width of 22 meters from surface | ||

| ARD69: | 0.39 g/t Au, 0.19% Cu over an estimated true width of 27 meters from 10 meters | ||

| ARD71: | 0.52 g/t Au, 0.15% Cu over an estimated true width of 57 meters from 72 meters, and 0.58 g/t Au, 0.12% Cu over an estimated true width of 27 meters from 210 meters, |

||

| ARD72: | 0.39 g/t Au, 0.18% Cu over an estimated true width of 21 meters from surface, and 0.59 g/t Au, 0.29% Cu over an estimated true width of 46 meters from 100 meters |

||

| ARD74 | 0.50 g/t Au, 0.19% Cu over an estimated true width of 10 meters from 174 meters | ||

Refer to Appendix 1 for full details of the drill holes and assay results for this drill program

Figure 6. Arizaro Deposit, Lindero Property, Argentina: Recent drill results

Quality Assurance & Quality Control (QA - QC)

All drilling data completed by the Company utilized the following procedures and methodologies. All drilling was carried out under the supervision of the Company’s personnel.

All reverse circulation (RC) drilling used a 5.25-inch face sampling pneumatic hammer with samples collected into 60-liter plastic bags. Samples were kept dry by maintaining enough air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Once collected, RC samples were riffle split through a three-tier splitter to yield a 12.5 percent representative sample for submission to the analytical laboratory. The residual 87.5 percent samples were stored at the drill site until assay results were received and validated. Coarse reject samples for all mineralized samples corresponding to significant intervals are retained and stored on-site at the Company-controlled core yard.

All diamond drilling (DD) drill holes started with HQ sized diameter, before reducing to NQ diameter diamond drill bits on intersecting fresh rock. The core was logged, marked up for sampling using standard lengths of one meter or to a geological boundary. Samples were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the Company core yard at the project site. The other half was sampled, catalogued, and placed into sealed bags and securely stored at the site until shipment.

All DD samples were transported by commercial transport to ALS Patagonia S.A preparation laboratory in Mendoza, Argentina. Sample pulps prepared by ALS Patagonia were then transported via commercial courier to ALS’s facility in Lima, Peru. Routine gold analysis using a 30-gram charge and fire assay with an atomic absorption finish was completed for all samples at ALS’s Lima laboratory plus ME-ICP61, analysis of 34 elements four acid ICP-AES. Samples returning assays >10 ppm Au were reanalyzed using a 30-gram charge and fire assay with a gravimetric finish. Quality control procedures included the systematic insertion of blanks, duplicates and sample standards into the sample stream. In addition, ALS and laboratory inserted their own quality control samples.

Qualified Person

Paul Weedon, Senior Vice President, Exploration for Fortuna Mining Corp., is a Qualified Person as defined by National Instrument 43-101 being a member of the Australian Institute of Geoscientists (Membership #6001). Mr. Weedon has reviewed and approved the scientific and technical information contained in this news release. Mr. Weedon has verified the data disclosed, including the sampling, analytical and test data underlying the information or opinions contained herein by reviewing geochemical and geological databases and reviewing diamond drill core. There were no limitations to the verification process.

About Fortuna Mining Corp.

Fortuna Mining Corp. is a Canadian precious metals mining company with three operating mines and a portfolio of exploration projects in Argentina, Côte d’Ivoire, Mexico, and Peru, as well as the Diamba Sud Gold Project in Senegal. Sustainability is at the core of our operations and stakeholder relationships. We produce gold and silver while creating long-term shared value through efficient production, environmental stewardship, and social responsibility. For more information, please visit our website at www.fortunamining.com

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Mining Corp.

Investor Relations:

Carlos Baca | info@fmcmail.com | fortunamining.com | X | LinkedIn | YouTube

Forward looking Statements

This news release contains forward-looking statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 (collectively, “Forward-looking Statements”). All statements included herein, other than statements of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements in this news release may include, without limitation, the Inferred Mineral Resource estimate at Arizaro; the Company’s proposed exploration plans and expected timing at its projects in Côte d’Ivoire, Mexico, and Argentina; statements about the Company’s business strategies, plans and outlook; the Company’s plans for its mines and mineral properties; changes in general economic conditions and financial markets; the impact of inflationary pressures on the Company’s business and operations; the future results of exploration activities; expectations with respect to metal grade estimates and the impact of any variations relative to metals grades experienced; assumed and future metal prices; the merit of the Company’s mines and mineral properties; and the future financial or operating performance of the Company. Often, but not always, these Forward-looking Statements can be identified by the use of words such as “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “proposed”, “used”, “detailed”, “has been”, “gain”, “planned”, “reflecting”, “will”, “anticipated”, “estimated” “containing”, “remaining”, “to be”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and factors include, among others, operational risks associated with mining and mineral processing; uncertainty relating to Mineral Resource and Mineral Reserve estimates; uncertainty relating to capital and operating costs, production schedules and economic returns; risks relating to the Company’s ability to replace its Mineral Reserves; risks related to the conversion of Mineral Resources to Mineral Reserves; risks associated with mineral exploration and project development; uncertainty relating to the repatriation of funds as a result of currency controls; environmental matters including obtaining or renewing environmental permits and potential liability claims; uncertainty relating to nature and climate conditions; laws and regulations regarding the protection of the environment (including greenhouse gas emission reduction and other decarbonization requirements and the uncertainty surrounding the interpretation of omnibus Bill C-59 and the related amendments to the Competition Act (Canada); risks associated with political instability and changes to the regulations governing the Company’s business operations; changes in national and local government legislation, taxation, controls, regulations and political or economic developments in countries in which the Company does or may carry on business; risks associated with war, hostilities or other conflicts, such as the Ukrainian – Russian, and Israeli – Hamas conflicts, and the impacts they may have on global economic activity; risks relating to the termination of the Company’s mining concessions in certain circumstances; developing and maintaining relationships with local communities and stakeholders; risks associated with losing control of public perception as a result of social media and other web-based applications; potential opposition to the Company’s exploration, development and operational activities; risks related to the Company’s ability to obtain adequate financing for planned exploration and development activities; property title matters; risks related to the ability to retain or extend title to the Company’s mineral properties; risks relating to the integration of businesses and assets acquired by the Company; impairments; risks associated with climate change legislation; reliance on key personnel; adequacy of insurance coverage; operational safety and security risks; legal proceedings and potential legal proceedings; uncertainties relating to general economic conditions; risks relating to a global pandemic, which could impact the Company’s business, operations, financial condition and share price; competition; fluctuations in metal prices; risks associated with entering into commodity forward and option contracts for base metals production; fluctuations in currency exchange rates and interest rates; tax audits and reassessments; risks related to hedging; uncertainty relating to concentrate treatment charges and transportation costs; sufficiency of monies allotted by the Company for land reclamation; risks associated with dependence upon information technology systems, which are subject to disruption, damage, failure and risks with implementation and integration; labor relations issues; as well as those factors discussed under “Risk Factors” in the Company's Annual Information Form for the fiscal year ended December 31, 2024. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in Forward-looking Statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking Statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including, but not limited to, the accuracy of the Company’s current Mineral Resource and Mineral Reserve estimates; that the Company’s activities will be conducted in accordance with the Company’s public statements and stated goals; that there will be no material adverse change affecting the Company, its properties or its production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing, and recovery rate estimates and may be impacted by unscheduled maintenance, labor and contractor availability and other operating or technical difficulties); the duration and effect of global and local inflation; the duration and impacts of geo-political uncertainties on the Company’s production, workforce, business, operations and financial condition; the expected trends in mineral prices, inflation and currency exchange rates; that all required approvals and permits, as well as surface agreements, will be obtained for the Company’s business and operations on acceptable terms; that there will be no significant disruptions affecting the Company's operations and such other assumptions as set out herein. Forward-looking Statements are made as of the date hereof and the Company disclaims any obligation to update any Forward-looking Statements, whether as a result of new information, future events, or results or otherwise, except as required by law. There can be no assurance that these Forward-looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on Forward-looking Statements.

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources

All reserve and resource estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by a Canadian company of scientific and technical information concerning mineral projects. All Mineral Reserve and Mineral Resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves. Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission, and mineral reserve and resource information included in this news release may not be comparable to similar information disclosed by U.S. companies.

Appendix 1: Lindero Property details of the drill holes and assay results for the Regional and Arizaro drill program

| HoleID | Easting | Northing | Elev.(m) | EOH1 Depth (m) | Azimuth | Dip | Depth2 From (m) | Depth2 To (m) | Drilled2 Width (m) | ETW3 (m) | Au (ppm) | Cu (%) | Hole Type4 | Area |

| ARD-66 | 2625160 | 7223620 | 4108 | 500 | 180 | -60 | NSI | DD | Regional | |||||

| ARD-67 | 2625162 | 7223622 | 4108 | 300 | 130 | -60 | NSI | DD | Regional | |||||

| ARD-68 | 2625637 | 7223660 | 4091 | 400 | 270 | -60 | 0 | 44 | 44 | 22 | 0.69 | 0.40 | DD | Arizaro |

| ARD-69 | 2625571 | 7223885 | 4083 | 200 | 180 | -60 | 10 | 64 | 54 | 27 | 0.39 | 0.19 | DD | Arizaro |

| ARD-70 | 2625747 | 7223946 | 4064 | 250 | 345 | -60 | 6 | 16 | 10 | 5 | 0.47 | 0.23 | DD | Arizaro |

| 146 | 162 | 16 | 8 | 0.40 | 0.32 | DD | Arizaro | |||||||

| 210 | 240 | 30 | 15 | 0.33 | 0.18 | DD | Arizaro | |||||||

| ARD-71 | 2625540 | 7223915 | 4082 | 272.5 | 180 | -60 | 72 | 186 | 114 | 57 | 0.52 | 0.15 | DD | Arizaro |

| 210 | 262 | 54 | 27 | 0.58 | 0.12 | DD | Arizaro | |||||||

| ARD-72 | 2625616 | 7223928 | 4074 | 200 | 0 | -60 | 0 | 42 | 42 | 21 | 0.39 | 0.18 | DD | Arizaro |

| 100 | 192 | 92 | 46 | 0.59 | 0.29 | DD | Arizaro | |||||||

| ARD-73 | 2625534 | 7223905 | 4076 | 257 | 180 | -60 | 134 | 144 | 10 | 5 | 0.41 | 0.08 | DD | Arizaro |

| ARD-74 | 2625629 | 7224059 | 4059 | 250.9 | 0 | -60 | 174 | 204 | 30 | 10 | 0.50 | 0.19 | DD | Arizaro |

| ARD-75 | 2625420 | 7223883 | 4098 | 272 | 180 | -60 | pending results | DD | Arizaro | |||||

| ARD-76 | 2625454 | 7223899 | 4089 | 302.5 | 180 | -60 | pending results | DD | Arizaro | |||||

| ARD-77 | 2625641 | 7223659 | 4092 | 319 | 180 | -60 | pending results | DD | Arizaro | |||||

| ARD-78 | 2625411 | 7223914 | 4089 | 250 | 195 | -60 | pending results | DD | Arizaro | |||||

| ARD-79 | 2625773 | 7223718 | 4097 | 299.5 | 165 | -60 | pending results | DD | Arizaro | |||||

| ARD-80 | 2625684 | 7223195 | 4052 | 320 | 180 | -60 | pending results | DD | Regional | |||||

| ARD-81 | 2625675 | 7223660 | 4097 | 200.5 | 270 | -60 | pending results | DD | Arizaro | |||||

| ARD-82 | 2625681 | 7223243 | 4047 | 227.5 | 270 | -60 | pending results | DD | Regional | |||||

| ARD-83 | 2625594 | 7223631 | 4085 | 200 | 90 | -60 | pending results | DD | Arizaro | |||||

| ARD-84 | 2625573 | 7223238 | 4166 | 300 | 90 | -60 | pending results | DD | Regional | |||||

| ARD-85 | 2624633 | 7223101 | 4148 | 263 | 90 | -60 | pending results | DD | Regional | |||||

| ARD-86 | 2624469 | 7223106 | 4123 | 230 | 90 | -60 | pending results | DD | Regional | |||||

| ARD-87 | 2625437 | 7224188 | 4008 | 281.5 | 90 | -60 | pending results | DD | Regional | |||||

| ARD-88 | 2624684 | 7223108 | 4162 | 150 | 90 | -60 | pending results | DD | Regional | |||||

| ARD-89 | 2624636 | 7223210 | 4164 | 254 | 90 | -60 | pending results | DD | Regional | |||||

1. EOH: End of hole

2. Depths and widths reported to nearest significant decimal place

3. ETW: Estimated true width

4. DD: Diamond drill core

5. NSI: No significant intercepts

A PDF accompanying this announcement is available at:

http://ml.globenewswire.com/Resource/Download/00a63605-2b3d-49ab-80c7-83e3d248b51d

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6a9630b5-df31-4131-9c79-787510457324

https://www.globenewswire.com/NewsRoom/AttachmentNg/40348a96-deea-46d3-9e61-30dcf0dc10cb

https://www.globenewswire.com/NewsRoom/AttachmentNg/33207179-9b07-4eb0-9051-2531b2bf5e97

https://www.globenewswire.com/NewsRoom/AttachmentNg/e1ce42c3-2567-48d0-b4a2-38f9e2fd2be0

https://www.globenewswire.com/NewsRoom/AttachmentNg/fccb453d-8571-4396-90f7-e44264f312db

https://www.globenewswire.com/NewsRoom/AttachmentNg/295f7213-81d5-4c6a-9d7b-0440de66726d

Figure 1

Guiglo Project exploration program, Côte d’Ivoire

Figure 2

Tongon North exploration program, Côte d’Ivoire

Figure 3

Location of current exploration programs in Mexico

Figure 4

Centauro Project, Mexico: Geological plan and interpretive cross section

Figure 5

Cerro Lindo, Argentina: Location and spectral imagery

Figure 6

Arizaro Deposit, Lindero Property, Argentina: Recent drill results

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.